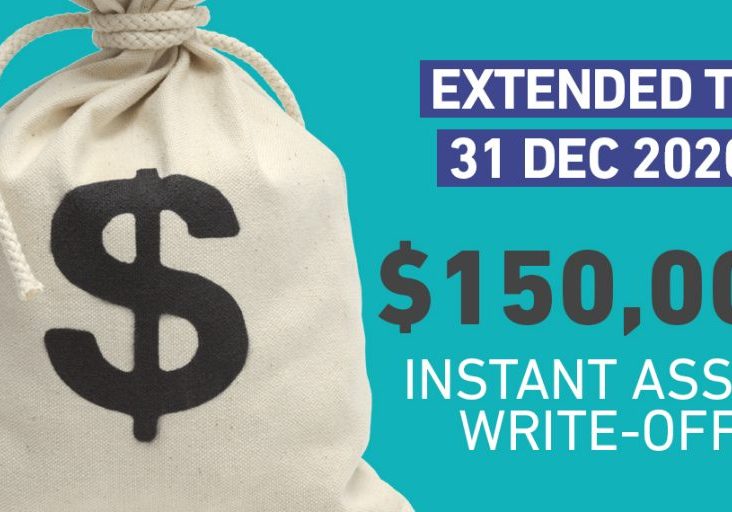

$ 150,000 Instant Asset Write-Off

The $150,000 Instant Asset Write–Off provides businesses with an asset write–off of up to $150,000 for assets costing less than the instant asset write–off threshold which are purchased and used in the year that the write–off is claimed

Posted in Machines